Why a Pre-Listing Inspection May Be Worth It in Today’s Market.

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection. That’s why it pays to anticipate potential issues before buyers ever step through the door. And one way to do that is with a pre-listing inspection.

What Is a Pre-Listing Inspection?

A pre-listing inspection is essentially a professional home inspection you schedule before putting your house on the market. Just like the inspections your buyer will do after making an offer, this process identifies any issues with the condition of your house that could have an impact on the sale – like structural problems, faulty or outdated HVAC systems, or other essential repairs.

While it’s a great option if you’re someone who really doesn’t like surprises, Bankrate explains this may not make sense for all sellers:

“While it can be beneficial for a seller to do, a pre-listing inspection isn’t always necessary. For example, if your home is relatively new and you’ve been the only owner, you’re most likely already aware of any big issues that could impact a sale. But for an older home, a pre-listing inspection can be very insightful and help you get ahead of any potential problems.”

The key is deciding whether the benefits outweigh the costs for your situation. Sometimes a few hundred dollars now can get you information that’ll save you a lot of time and hassle later on.

Why It May Be Worth Considering in Today’s Market

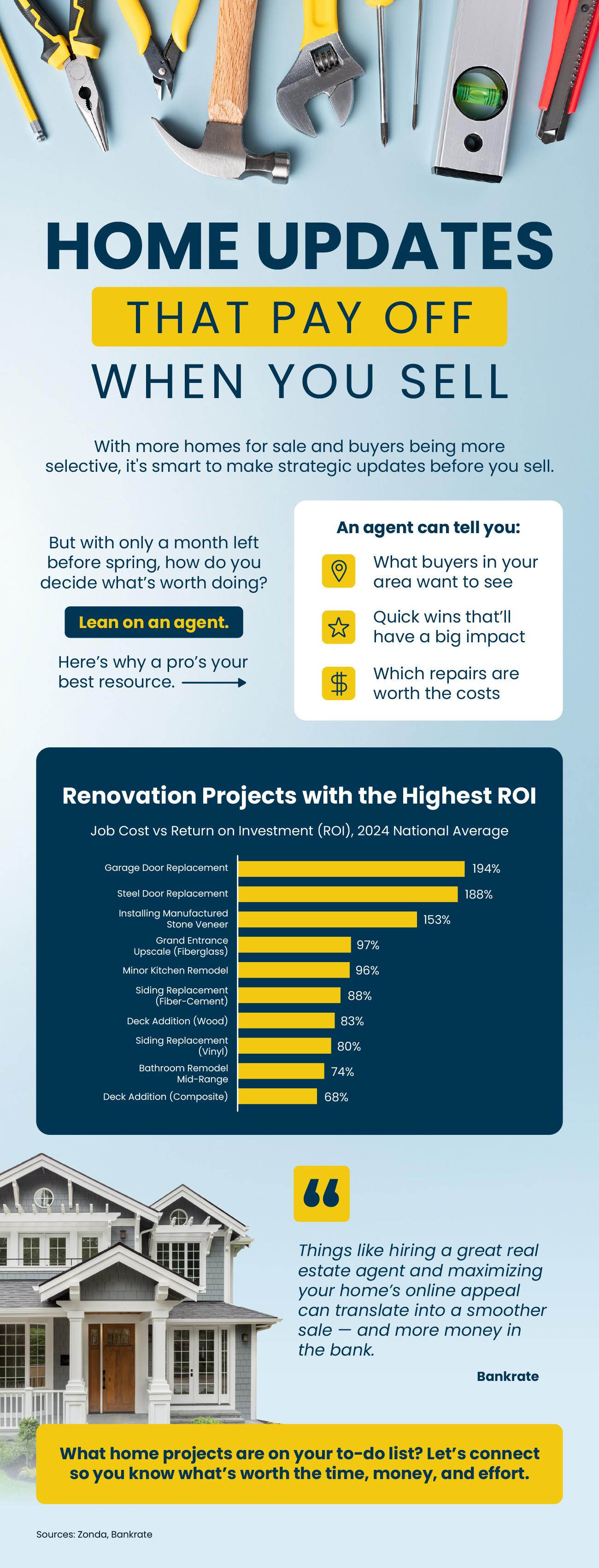

Right now, buyers are more cautious about how much money they’re spending. And they want to be sure the home they’re buying is worth the expense. In a market like this, a pre-listing inspection can be your secret weapon to make sure your house shows well. Here are just a few ways it can help:

- Gives You Time To Make Repairs: When you know about issues ahead of time, it gives you the chance to fix them on your schedule, rather than rushing to make repairs when you’re under contract.

- Avoid Surprises During Negotiations: When buyers discover issues during their own inspection, it can lead to last-minute negotiations, price reductions, or even a deal falling through. A pre-listing inspection gives you a chance to spot and address any problems ahead of time, so they don’t turn into last-minute headaches or negotiation roadblocks.

- Sell Your House Faster: According to Rocket Mortgage, if your house is listed in the best shape possible, there won’t be as many reasons for buyers to ask for concessions. That means you should be able to cut down on negotiation timelines and ultimately sell faster.

How Your Agent Will Help

But before you think about reaching out to any inspectors to get something scheduled, be sure to talk to an agent. Your agent will be able to give you advice on whether a pre-inspection is worthwhile for your house and the local market. Because it may not be as important if sellers still have the majority of the negotiation power where you live.

If your agent does recommend moving forward and getting one done, here’s how they’ll support you throughout the process.

- Offer Advice on How To Prioritize Repairs: If the inspection uncovers problems, your agent will sit down with you and offer perspective on what’s going to be a sticking point for buyers so you know what to prioritize.

- Knowledge of How To Handle Any Disclosure Requirements: After talking to your agent, you may decide not all of the repairs are worth it right now. Just be ready to disclose what you’re not tackling. Some states require disclosures as a part of a listing – lean on your agent for more information.

Bottom Line

While they’re definitely not required, pre-listing inspections can be especially helpful in today’s market. By understanding your home’s condition ahead of time, you can take control of the process and make informed decisions about what to fix before you list and what to disclose.

If you choose to skip this step, you may be just as surprised as your buyer by what pops up in their inspection. And that could leave you scrambling. Would you rather fix issues now or risk trying to save the deal later?

Connect with a local agent to see if this is a step that makes sense in your market.