You may have heard chatter recently about the economy and talk about a possible recession. It’s no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

1. Demand for Homes Is Higher than Supply

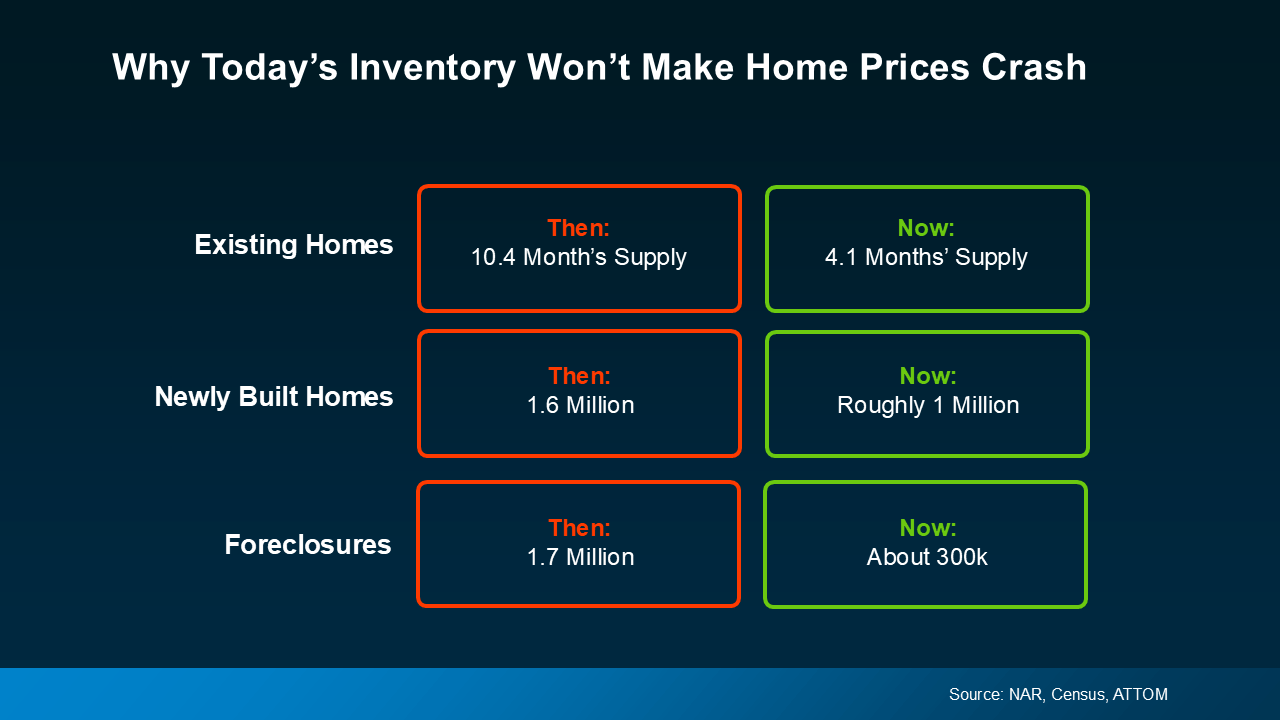

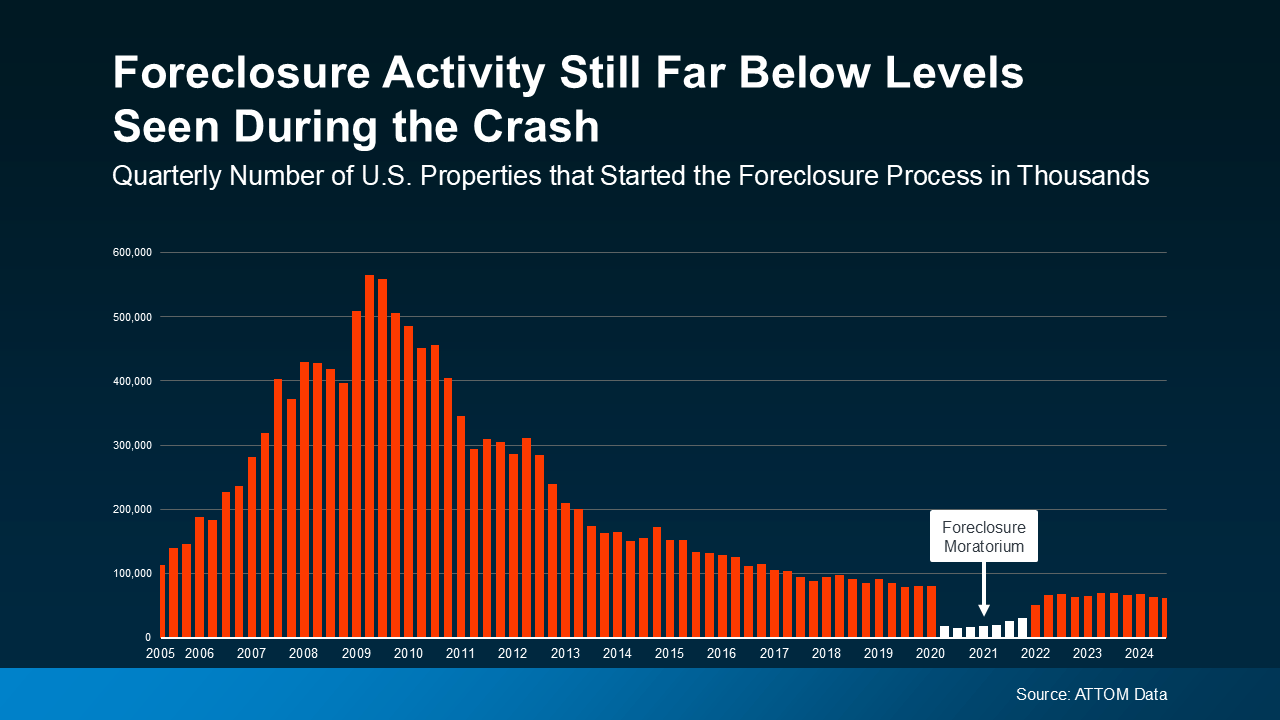

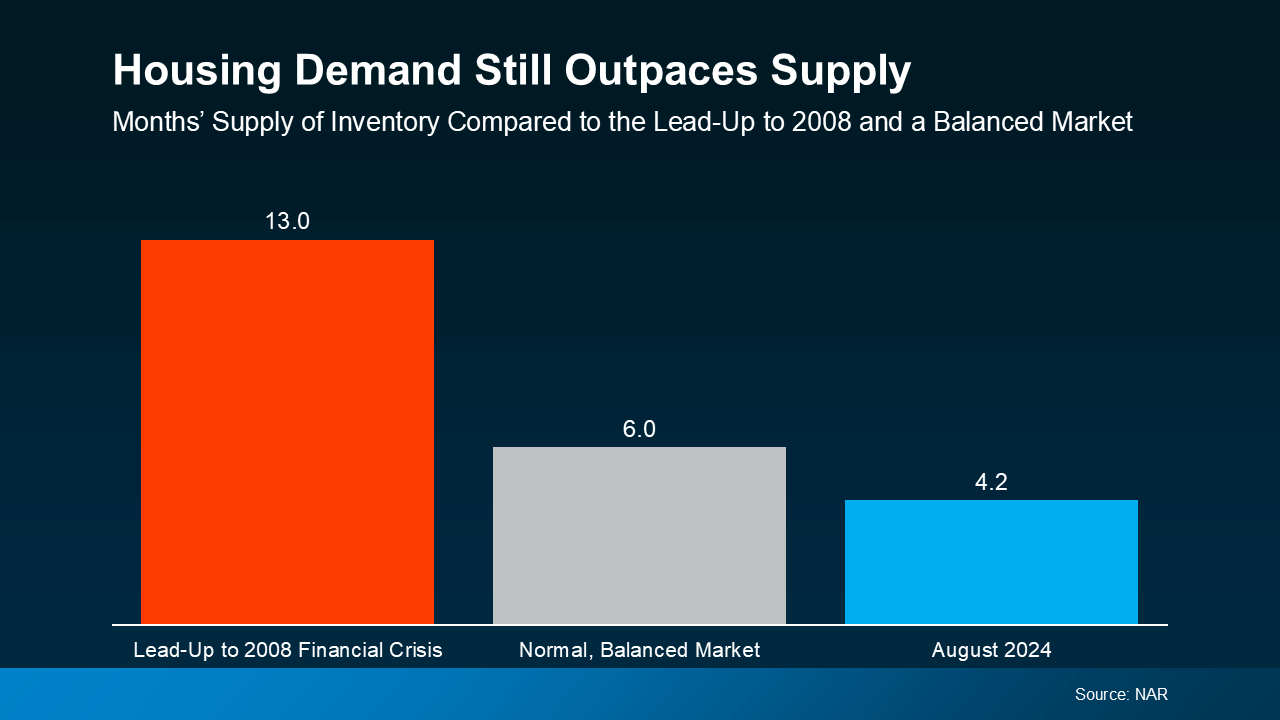

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

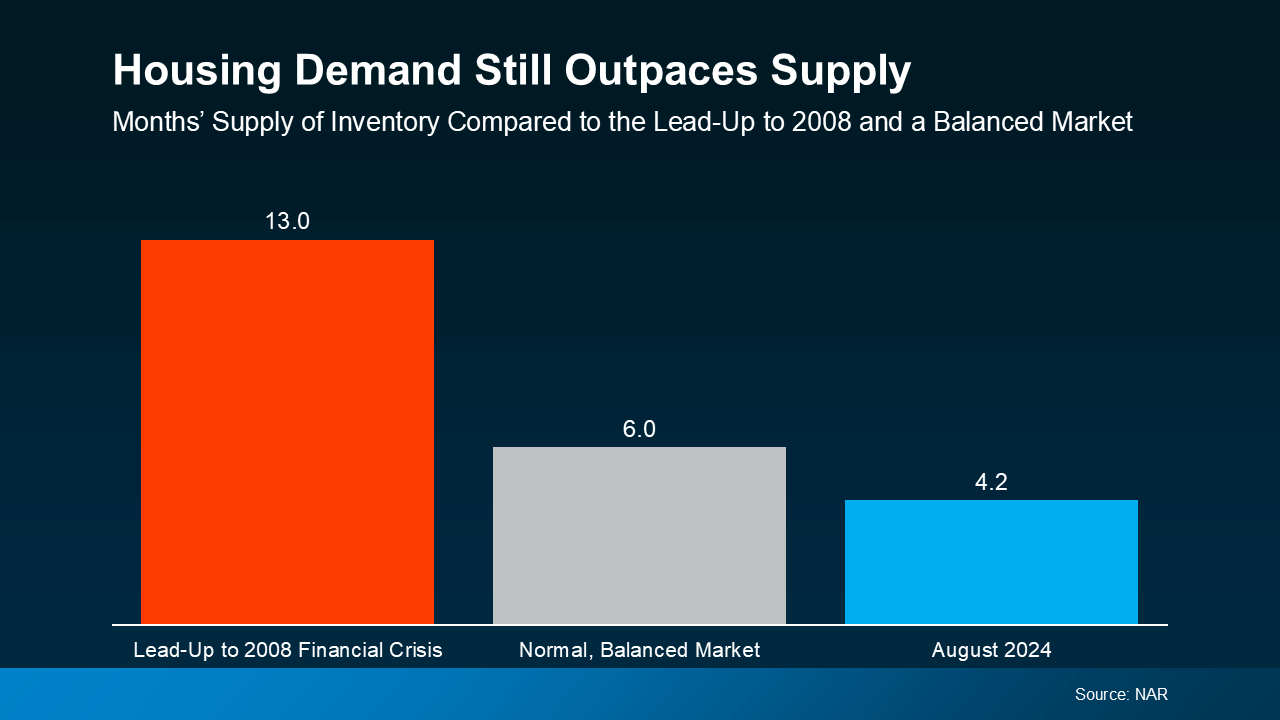

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

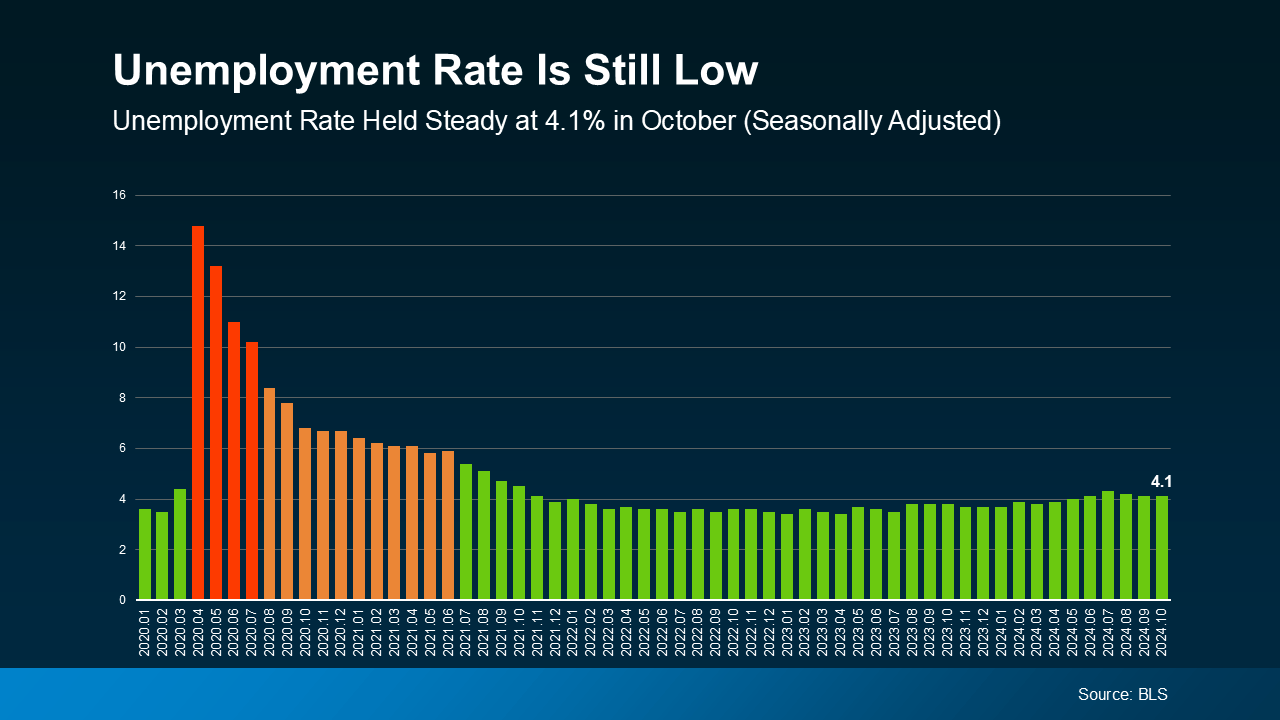

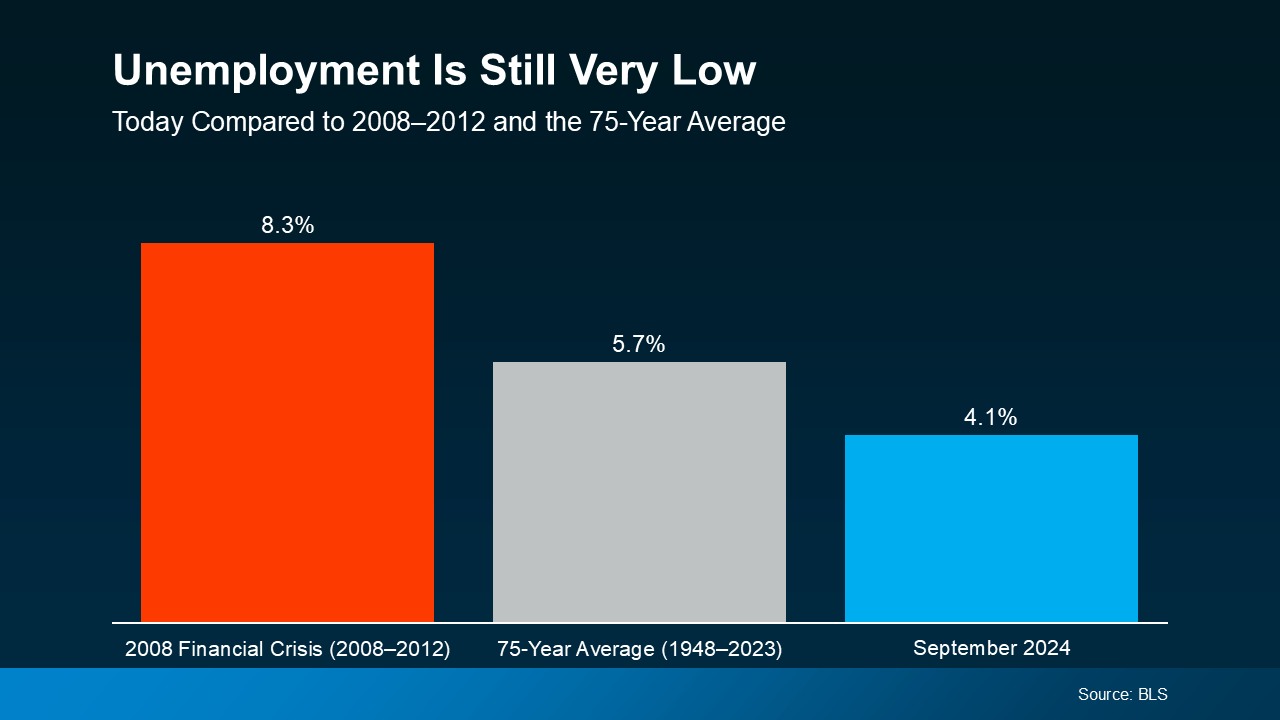

2. Unemployment Is Still Low

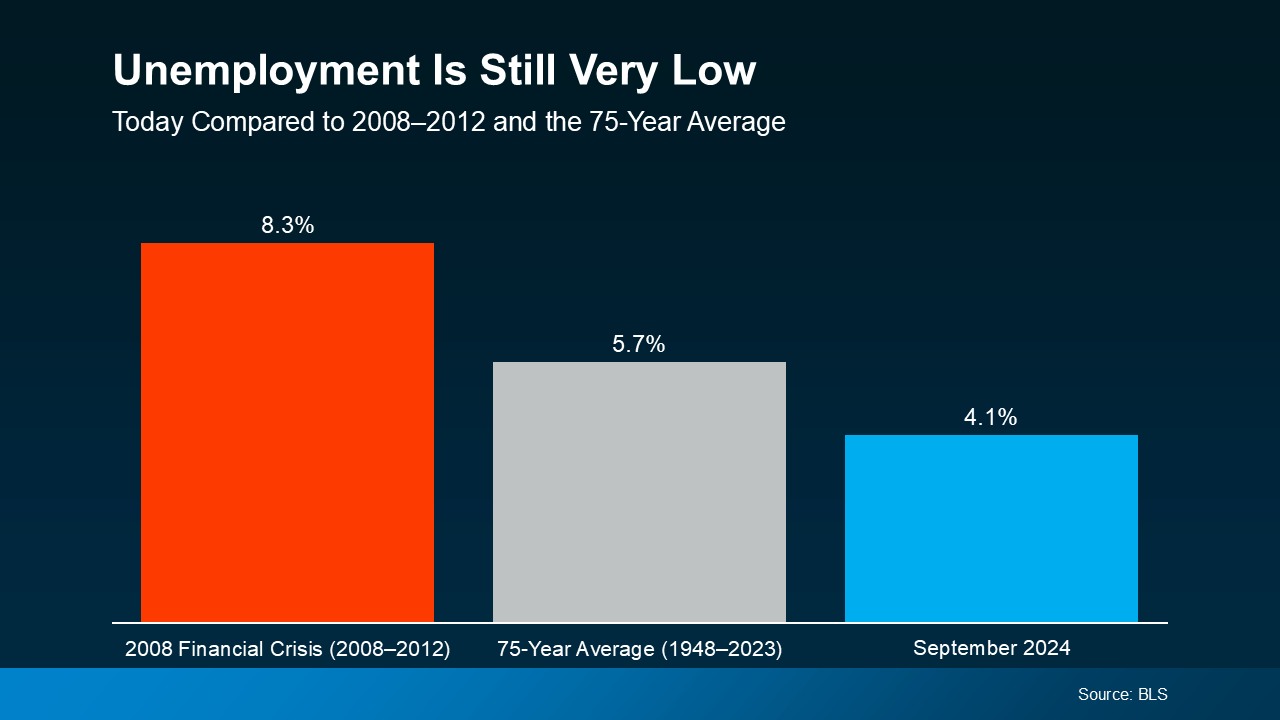

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable (see graph below):

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

Bottom Line

The housing market is in a much better place than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about your specific market. If you have any questions or want to discuss how these factors are playing out in your area, reach out to a local real estate agent.

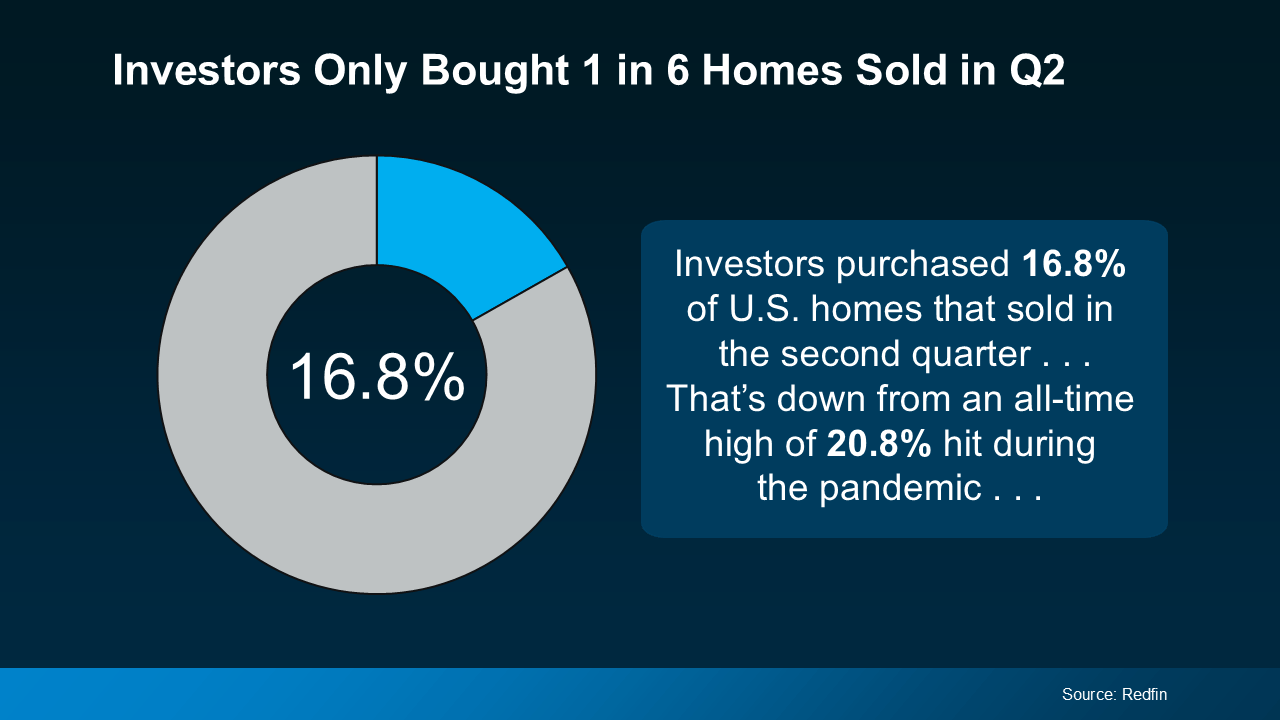

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

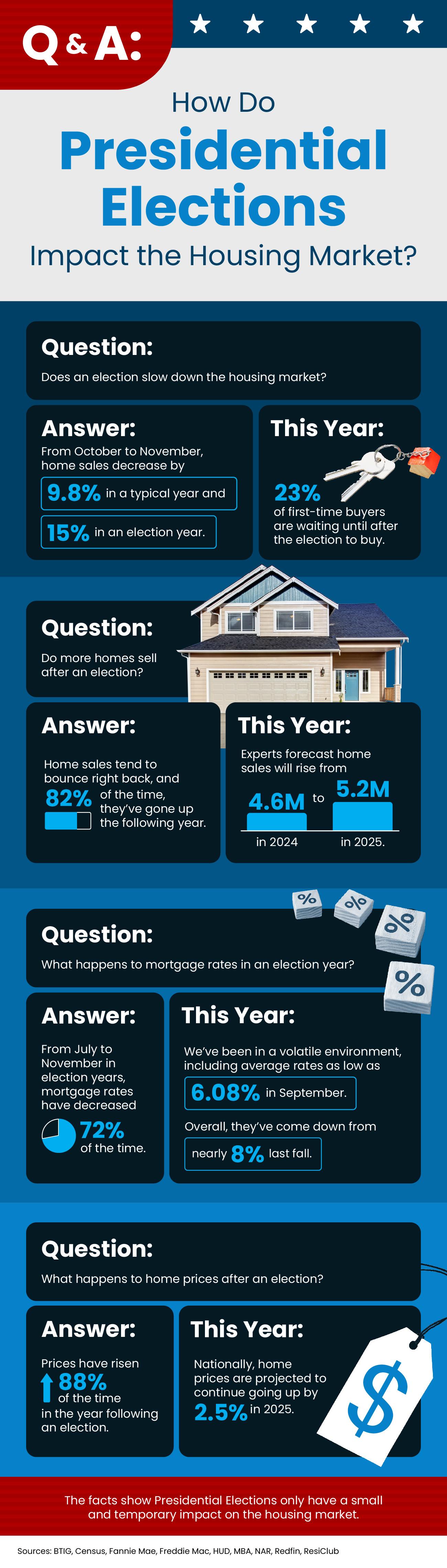

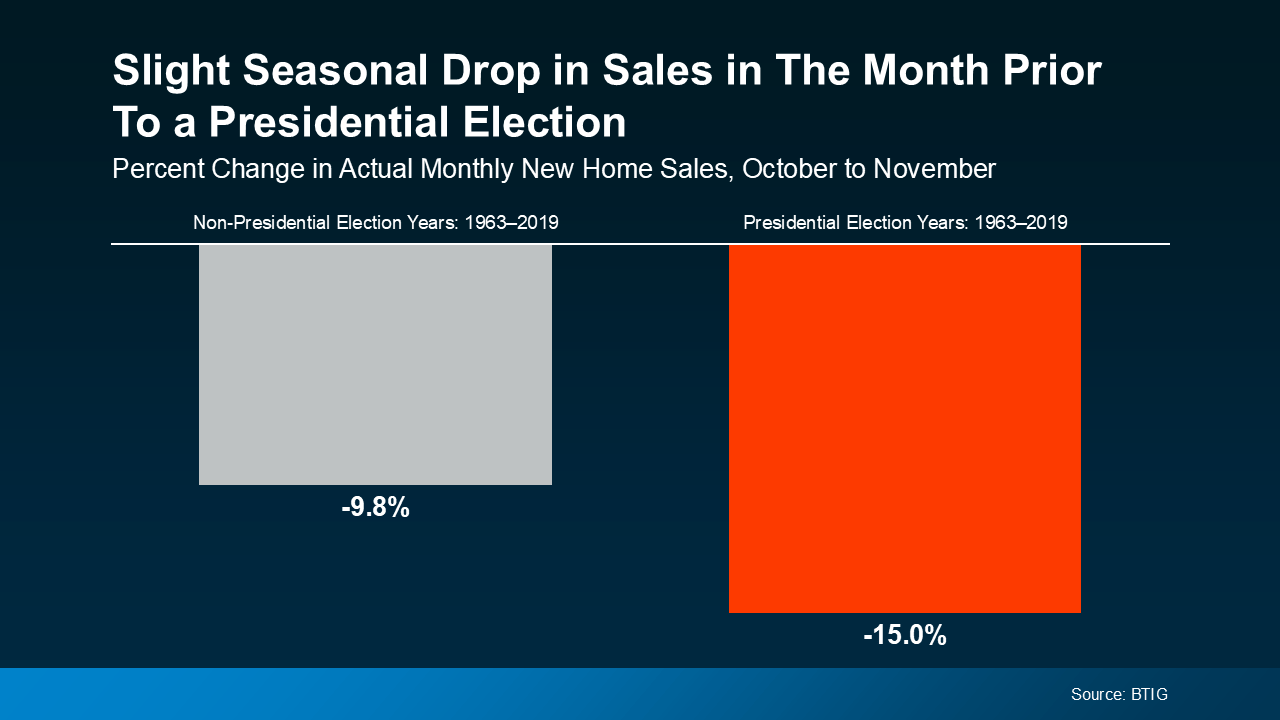

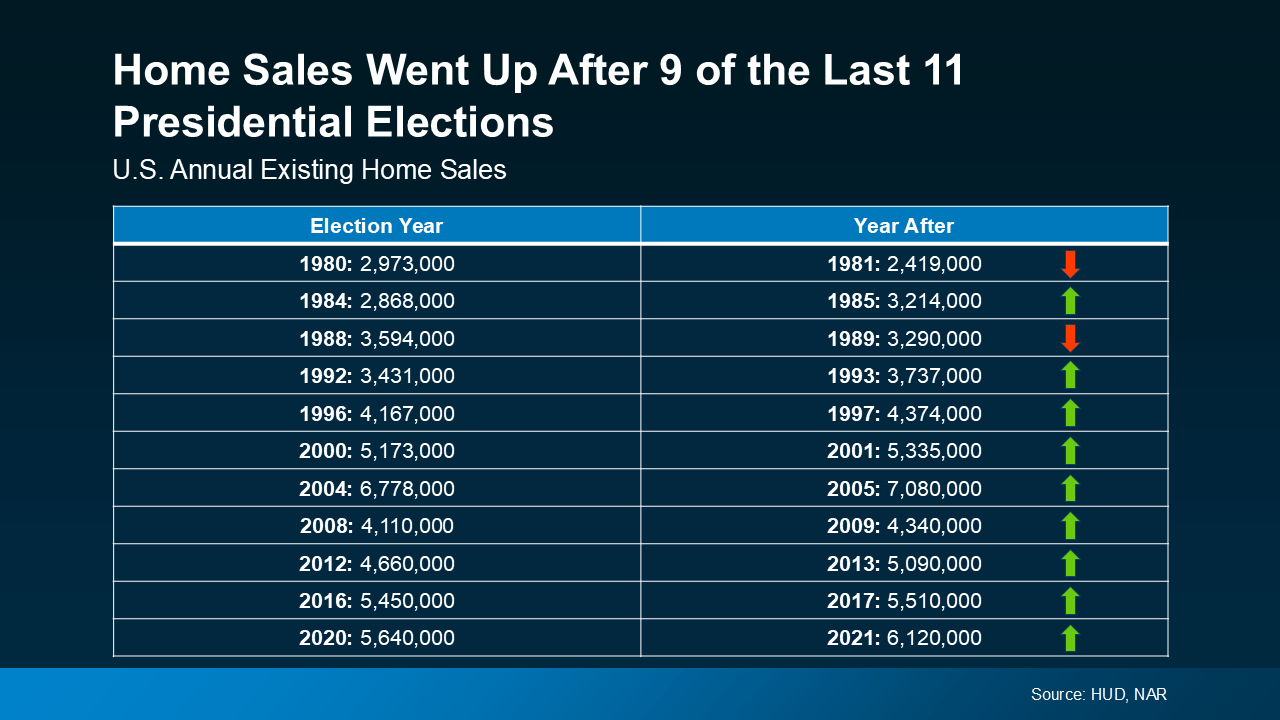

Some consumers will simply wait it out before they make their purchase decision.

Some consumers will simply wait it out before they make their purchase decision. Home Prices

Home Prices